Budget Application Guide

Purpose:

This guide is provided to document the

spreadsheet pages used for preparation of the annual Solano’s

budget. It does not address in detail how the monthly values

are determined but focuses on how the pages are used to

allocate and record data.

Overview:

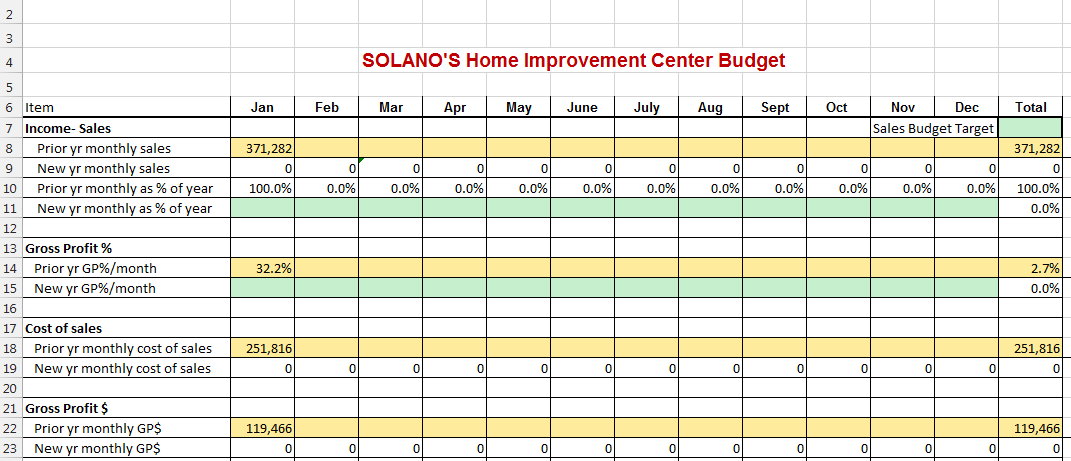

The layout of a typical budget page is

shown below. The red and green letters/numbers relate to the

spreadsheet rows and columns.

To assist the user, cells are color coded

to indicate the type of data to be entered/displayed.

Green cells indicate that data for the

year being budgeted is to be entered in the cell.

Yellow cells indicate that data for the

year prior is to be entered in the cell.

Red cells indicate that the particular

item does not apply to this specific organization.

Blue cells display the difference in

value between the year being budgeted and the prior year actual

values.

Per spreadsheet custom, white cells with

a zero indicate that the cell content will be produced by a

calculation. Warning! Entering data by typing in a

white

cell will destroy the formula attached to the cell.

Overwriting the formula is allowed when the user has reason to

alter the calculation process. For example, changing the

monthly distribution from the pattern established in the prior year.

As the budget for the upcoming year is

normally prepared in December, prior year data is defined as data

from the current year for the period January through November plus

data from the previous December.

Preparation:

The first step in preparing a budget is to enter prior year historical data. As described in the Introduction to Financial Management flow chart, this information is to be entered in several locations within the spreadsheet page for an entity as each month of the prior year data becomes available in the General Ledger reports. As shown below sales and margin data is entered in the area bound by cells B8 to M22, in the yellow cells. The totals in column N are calculated by the application.

.

As shown below, additional history data is to be entered in Cells B101 to M107. The totals for these items are entered into cells P36 to P43 by the application.

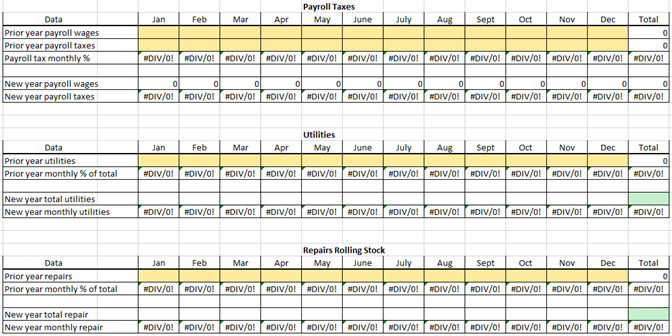

The majority of prior year data is

entered for the expense accounts in the area bound by cells Z123 to

AK227 for the four “stores” and Z123 to AK397 for Corporate

Services. A portion of this area is illustrated below.

Upon completion of entering historical

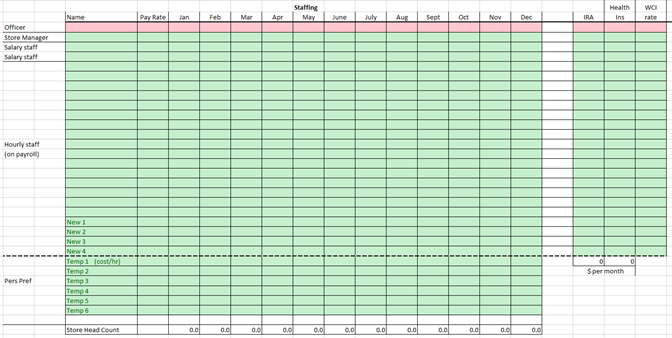

data the next step is to address staffing information.

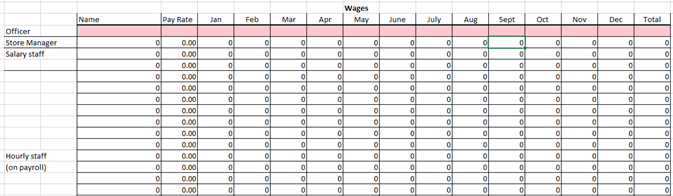

Current employee’s names, pay rate,

company contributions for IRA and health insurance and workers comp

rates are entered in the area bound by cells X7 to AO30. Pay

rate is per hour for non-exempt employees and per month for

managers. IRA and health insurance contributions are per

month. Workers comp rate is per payroll dollars.

If IRA, health insurance and WC data is

not available, only employee names and pay rates may be entered at

this time. With this data displayed, the budget preparer shall

meet with each store manager and have him/her indicate any

additions/deletions

and enter the planned scheduling of each employee, IE entering a 1

digit in each month for full time, a 1 plus tenths for planned

overtime, or a fraction of 1 for part time. Planned new hire

data (no name required) is to be entered in Rows 27 to 30.

Planned Personnel Preference seasonal employees are to be

shown/scheduled (no name required) in Rows 31 to 36. Their pay

rate is the total rate invoiced by Personnel Preference. The

referenced area of the spreadsheet page is shown below.

With the aforementioned data entered, the

application will calculate wages, IRA (employee benefits), health

insurance, workers comp, and payroll taxes expense. Payroll

taxes/ month is based on the prior year monthly distribution of the

annual amount.

It should be noted that at this point in the procedure a decision regarding employee COLA and manager bonuses may not been made by the CEO. When guidelines are received, the pay rates must be revised and manager bonus amounts added to manager wages in the proper months (usually October and December). The adjusted monthly wages for the managers is entered by scheduling additional hours in the applicable months. For example a manager might be scheduled for 1.6 instead of 1 for the months of October and December for a 5% annual bonus.

At this point, the budget preparer will

meet with the CEO to develop guidelines or specific values for

sales, margin percentages and expenses for each of the entities. The

following procedure is followed for entering data that was provided

by the CEO and developing the new budget.

1) Enter the annual

sales value in cell N7

2) Enter the monthly

distribution percentages in cells B11 to M11. The prior year

distribution is provided on row 10 for reference. If the prior

year had a severe weather month that caused significant lower than

normal sales volume, or some other factor distorted sales, this can

be corrected when selecting the new values. The total shown

in cell N11 must equal 100%

3) Enter the monthly

distribution of gross profit percentages in cells B15 to M15,

referring to the prior year values displayed in row 14.

Generally, the prior year distribution will be applicable unless

there is significant change in the product mix sold. The

total shown in cell N15 must match the value specified by the CEO.

4) Recording expense

projections follows the same general concept as sales and gross

profit IE the new year’s selected value is, by default, distributed

monthly based on prior year history. This distribution may be

altered by over typing. The new year’s annual amount is

entered in the respective green cell, starting with the Utilities

account, cell AL136.

5) Upon completion of

developing the monthly expenses, the totals for each expense account

should be checked to determine that the guidelines issued by the CEO

have been met. The totals shown in column N are to be reviewed

to assure the process is correct.

At this

point the budget is complete and subject for review by the CEO if

requested. If acceptable, the final step is to provide copies

of applicable reports to the store managers and others.

Distribution is as follows:

1)

CEO – A printed copy of each entities’ budget and the total

corporation report (Columns AT to BG). An email with attached

Financial Management Application

file.

2)

Accounting Manager – Same as the CEO

3)

Store Managers -- A printed copy of their entities’ budget

The

Accounting Manager shall input the monthly budget data into the

General Ledger System and provide monthly and year to date reports

comparing budget to actual performance for each entity and corporate

total.