Restocking Fee:

.

As we all know there are times when we return

product to vendors and we are assessed restocking fees. There are

some important things to note. First of all, a

restock fee is a service charge much like delivery or labor.

Realistically the value of the product does not change and the

actual thing that is being done is assessing a service charge to the

customer for having to do the work to return the product. Restocking

charges CAN NOT be simply subtracted from retail prices and product

costs in a POS transaction. Doing this completely

throws off the numbers behind the scenes.

Steps:

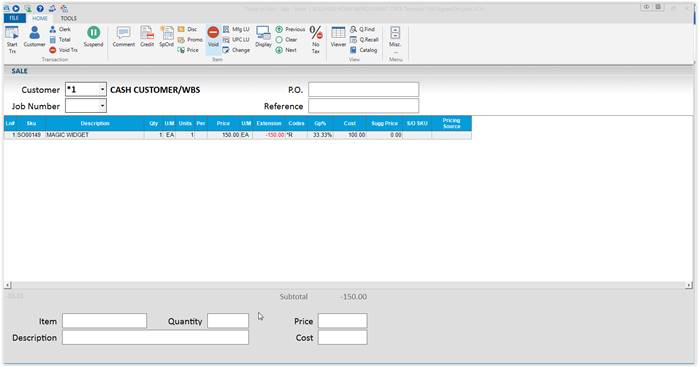

1.

If the item is an SO sku contact a

supervisor to make item returnable In POS. In POS start an order.

Return the product being returned using the SKU it was sold under

for using the FULL

retail and FULL

cost that the customer was invoiced at.

Do not adjust costs or retails on the

product SKU to account for the restocking fee even if the credit

acknowledgement from the vendor incorporates the restock fee into

the cost of the material!!

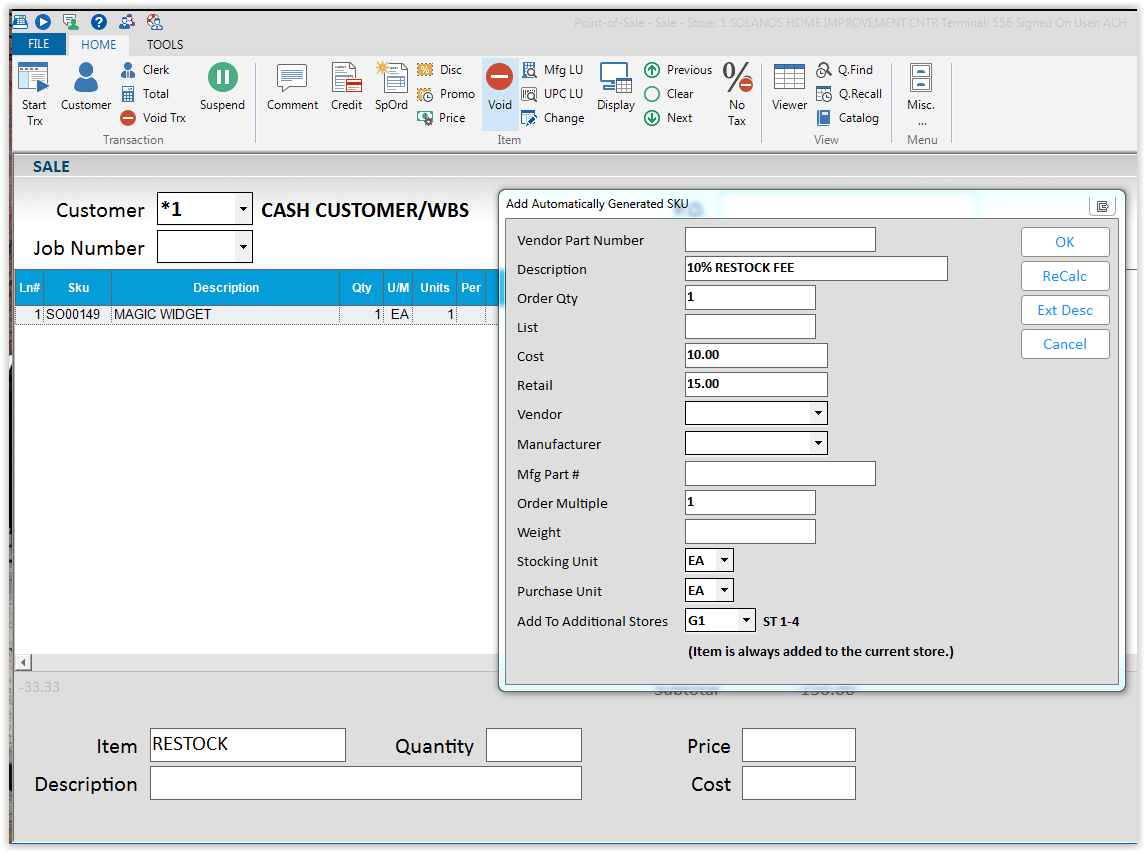

2.

Use the template SKU “RESTOCK” to create

an SO SKU for the restock fee. You will get the usual pop up screen

for SO items. Enter what the vendor is charging us for the

restocking fee in Cost and what you are charging the customer in the

Retail. If the vendor is not charging us a restock fee but you are

charging the customer a restock fee then the cost obviously would be

.001. In the example shown below we are using a 10% restock fee from

the vendor to us and a 10% restock fee from us to the customer.

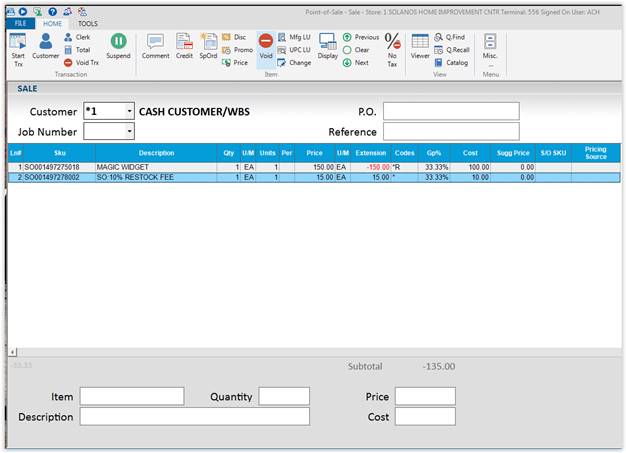

3.

Save and Print the order.

4. Create

a credit P.O. in purchasing and receiving. Use the original P.O.

number followed by “a” for a P.O. Number. Use the full cost that the

product was received at for the credit P.O.

Do not adjust cost of the

product to account for the restock fee. Print a copy of the

Credit P.O.

5.

Build a normal P.O. in purchasing and

receiving. Use the Original P.O. number followed by “B” for a P.O.

number. Add the restock fee to the purchase order using the SO SKU

that was created within the order in POS.

This will account for what

the vendor is charging us for the restocking. Print a copy of

the P.O.

6.

Return to Point of Sale and invoice the

order, be sure to print an invoice for this P.O.S. transaction.

7.

Attach the credit

acknowledgement from the vendor, copy of the credit P.O. for the

product, copy of the regular P.O. for the Restock Fee, and a copy of

the invoice of the P.O.S. transaction crediting the customer for the

material and charging the restock fee together and turn in to

receiving office.