Travel Expense Policy:

Travel Expense Policy

Summary:

This policy covers employee incurred

expenses related to transportation, lodging, meals and incidentals

while conducting business activities. The defined policy

complies with Federal and State regulations and will result in no

travel expenses being required to be reported on an employee’s W-2

Form.

Transportation:

Airline fares and auto rental fees shall

be charged to a company credit card, if available, or paid by the

employee. In either case, documentation including receipts

shall be attached to a travel expense form as discussed below.

Airline travel shall be in the lowest class fare available, auto

rental shall be for a midsized or compact vehicle.

A personal vehicle may be used if a

company vehicle is not available. If more than one employee is

required to make the trip, ride sharing shall be used to minimize

travel expense. A travel expense form shall be filled out and

the employee auto owner shall be reimbursed at the federal approved

rate (56 cents/mile for 2015).

Lodging:

Choice of lodging shall be based on

convenience and availability. Lodging expenses shall be paid

by company credit card or by the employee. Meals and

incidental expense must not be included in the lodging

expense report. Reporting forms to be used are described below.

Meals and incidentals:

Meals and incidental expenses shall be

paid by the employee and will be reimbursed at the federal per diem

rate ($52/day for most locations, $65/day for select high cost

areas, for 2015). No receipts or documentation other than

dates and location and purpose information is required to be

submitted.

Forms:

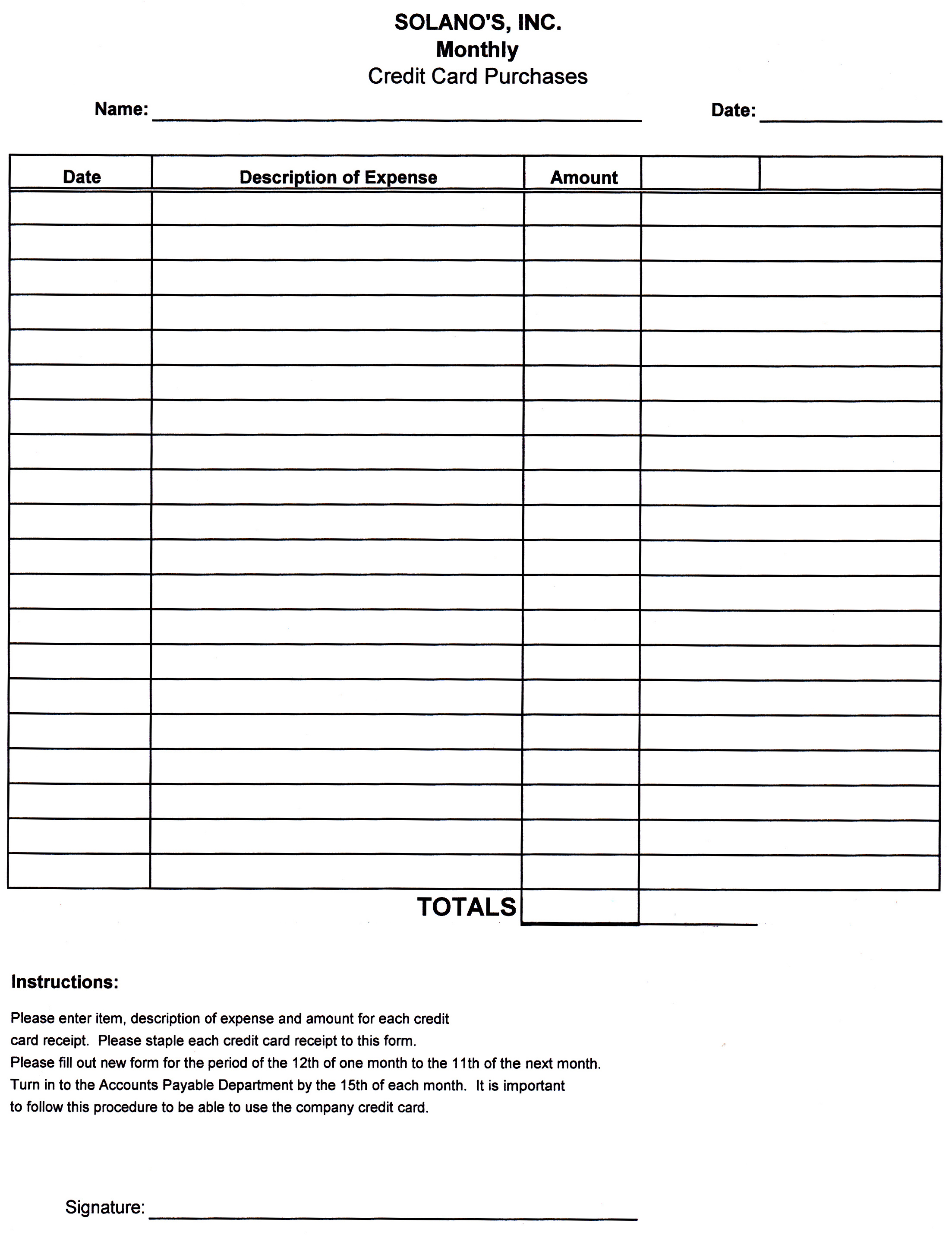

Company credit card purchases

Employee must itemize charges made when

using a company credit card. Also, the purpose and location(s)

of the trip shall be included on the reporting form, “Credit Card

Purchases”. Receipts shall be stapled to the form.

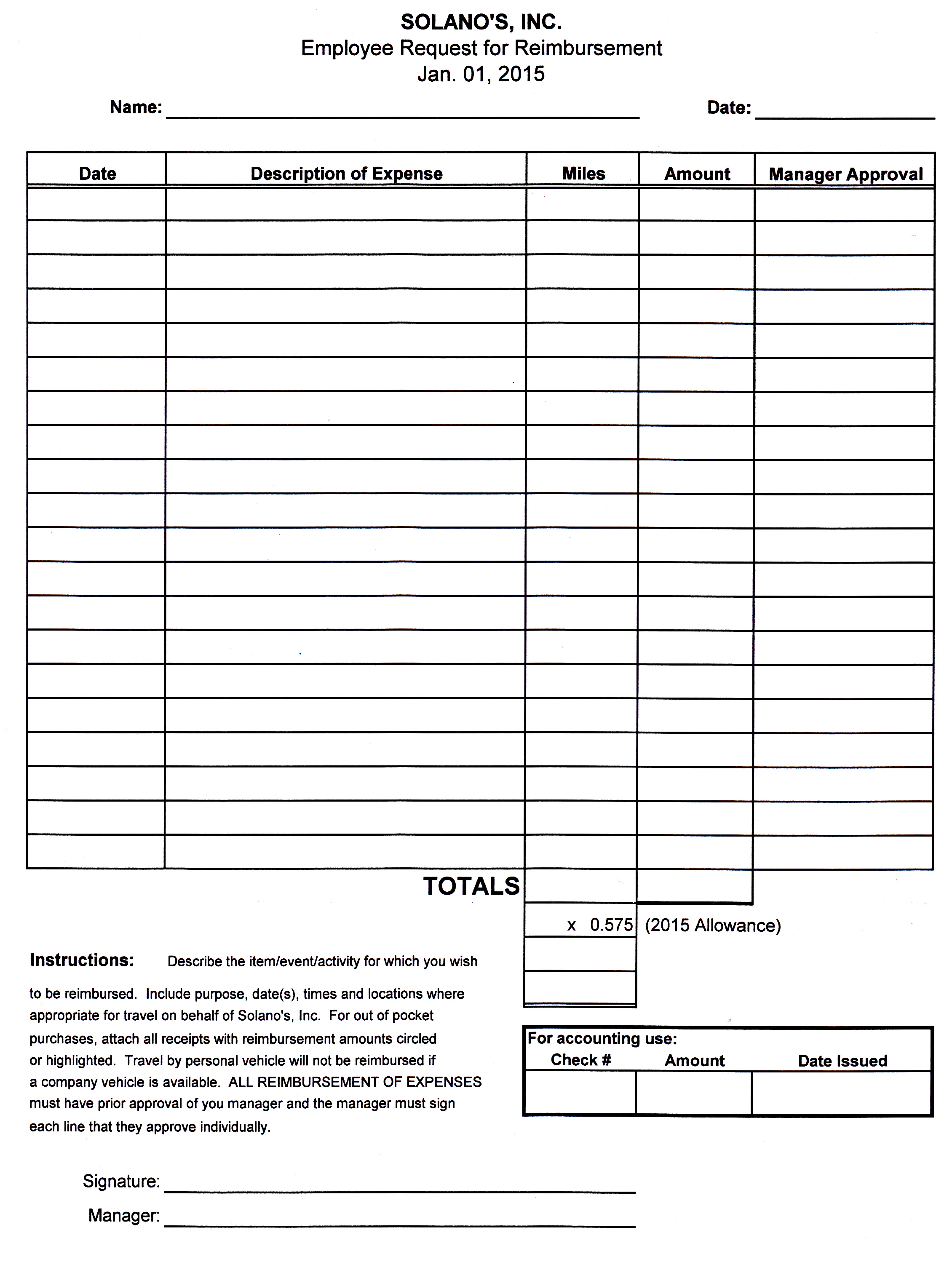

Employee paid purchases

Employee must itemize charges paid by the

employee. Also, the purpose and location(s) of the trip shall

be included on the reporting form, “Employee Request for

Reimbursement”. Receipts shall be stapled to the form.

No receipts for employee paid meals and/or incidentals are to be

included or itemized, however the number of days of the trip shall

be noted and will be reimbursed at the per diem rate. Mileage

information must be included for use of a personal vehicle.