Financial Management:

Introduction:

To survive as a successful company,

SOLANO’S must operate in a profitable manner, and several financial

tools and procedures are provided to assist in accomplishing this

goal. The Company measures performance against a sales and

expense budget and

cash flow projections. These are prepared as monthly forecasts and

are issued in January of each year

One objective of the financial management

system is to delegate financial management of each operating unit

(Store) to the respective store manager. The intent is to train our

management staff to be capable of assuming increased

responsibilities as the company continues to grow as well as

focusing store personnel on day to day decisions that affect

profitability.

As stated above, the budget is prepared in a manner that only assigns costs to each operational unit for items that can be managed by that unit, that is, no costs are allocated for “Corporate Services” such as accounting, or purchasing staff. Therefore, currently, the budget is prepared for five entities, the four stores and corporate staff and is consolidated into the corporate total. The pages for each entity are color coded to identify which accounts apply to the specific entity.

If an entity incurs a cost against a GL account that was not identified as applying to the entity during budget preparation, the entity is charged, to the proper account, and the result will appear as a budget variance.

Budget preparation

activity begins in early December. The CEO, working with the

Research Analyst, determines the anticipated

annual sales and margin % for each

of the four stores for the coming year.

The Research Analyst, based on historical data and planned future

operations, develops monthly values

by entity, reflecting the seasonal impact on sales volume for example

and past yearly totals of the various operating expense items for

comparison to the new budget values.

The annual budget becomes the baseline for measuring the company's financial performance. Therefore, the Performance Plus and manager bonus plans are based on actual versus budget data.

The following figure displays a portion of the budget document provided each entity.

An application guide has been prepared to document details of data entry and computations used in budget preparation. A link to this document is Budget Application Guide.

Cash Flow Analysis:

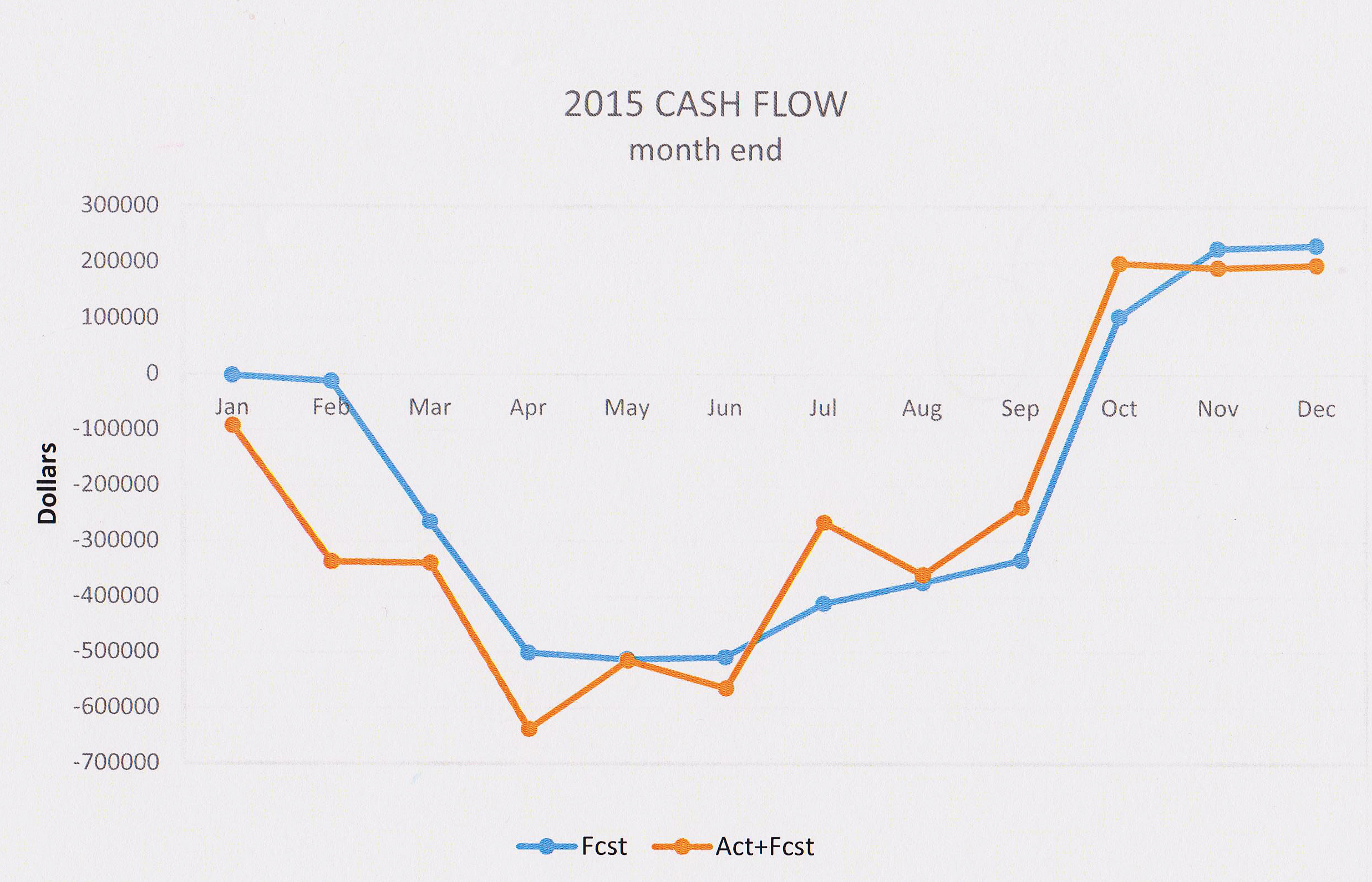

The second tool used for financial management is the Cash Flow Forecast. Using the approved annual budget for sales, other income, and operating expenses and notes payable data, a model is constructed of how income and expenses will occur during the year.

The nature of Solano's business is that it operates with a negative cash flow (money spent exceeds money received) for typically nine months out of the year. This shortfall must be made up by use of a line of credit from our major banking partner as well as cash reserves. Use of funds during the course of the year for additional equipment, wages etc. is affected by the company's cash flow performance. The budget, while forming a baseline to measure against does not cover all of the issues that affect cash flow. For example:

1) The budget estimates how much we will sell each month but does not identify who we will sell it to, hence when will we receive payment. The cash flow application divides sales into cash/credit card versus Solano account customers and models the latter's payments based on prior years history. Currently, payments for customer accounts are received 81% in the next month then 13%, 4%, 2% in following months. For cash/credit card transactions, bank deposits are used.

2) The budget calculates the cost of goods sold, based on margin % but does not define when those funds will be expended. The Cash flow application must recognize the need for increasing inventory before sales occur and decreasing inventory in anticipation of seasonal decline in sales.

3) Sales taxes, which are not included in the budget, must be paid in the month following the sale, however the Cash flow application has to account for the fact that we do not collect tax on customer account purchases until the customer pays his account.

4) The budgets include operating expenses but do not include debt repayment, income taxes, sales taxes, equipment loans etc. Cash flow must include these items.

The following chart demonstrates cash flow as predicted (forecast) versus actual for a typical year.

An application guide has been prepared to document details of data entry and computations used in the cash flow application. A link to this document is Cash Flow Application Guide.